All figures in Canadian dollars unless otherwise noted.

Highlights:

- Net assets increase by $24.5 billion

- 10-year net return of 9.2%

- CPP Investments recognized once again for its transparency, as we ranked second among 75 pension funds across 15 countries in the 2024 Global Pension Transparency Benchmark

TORONTO, ON (February 12, 2025): Canada Pension Plan Investment Board (CPP Investments) ended its third quarter on December 31, 2024, with net assets of $699.6 billion, compared to $675.1 billion at the end of the previous quarter.

The $24.5 billion increase in net assets for the quarter consisted of $26.0 billion in net income less $1.5 billion in net Canada Pension Plan (CPP) outflows. CPP Investments routinely receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by benefit payments exceeding contributions in the final months of the year.

The Fund, which consists of the base CPP and additional CPP accounts, generated a 10-year annualized net return of 9.2%. For the quarter, the Fund’s net return was 3.8%. Since its inception in 1999, and including the third quarter of fiscal 2025, CPP Investments has contributed $487.7 billion in cumulative net income to the Fund.

For the nine-month fiscal year-to-date period, the Fund increased by $67.2 billion consisting of $55.3 billion in net income, and $11.9 billion in net transfers from the CPP. For the period, the Fund’s net return was 8.6%.

“Returns were strong this quarter, delivering $26 billion in net income to the Fund. Our investment teams were very active with more than 40 transactions signed or closed in the last three months of the calendar year,” said John Graham, President & CEO, CPP Investments. “Even with considerable uncertainty on a global scale as 2025 begins, with the combination of a strong, experienced team and a resilient portfolio, we continue to seek out the best opportunities to deliver steady, long-term investment returns for the Fund.”

CPP Investments is achieving $700 billion in net assets five years ahead of the original projections by the Office of the Chief Actuary of Canada. Original projections of CPP Fund assets comprise the projections from the 18th Actuarial Report on the Canada Pension Plan (as at December 31, 2000) combined with the projections of the additional CPP Fund assets from the 30th Actuarial Report on the Canada Pension Plan (as at December 31, 2018). The Fund’s actual assets have exceeded the Office of the Chief Actuary’s initial assumptions partly due to strategic changes to our investment approach over this period.

In Q3, the Fund earned one of its largest ever quarterly increases on a dollar basis. This growth was driven by returns in most asset classes, particularly investments in private equity and credit. These gains were offset by losses in fixed income assets, which were impacted by increasing yields in U.S. Treasuries. While we anticipate volatility in general to affect overall results at various horizons, fluctuations caused by the depreciation of the Canadian dollar was especially prominent during this reporting period.

Performance of the Base and Additional CPP Accounts

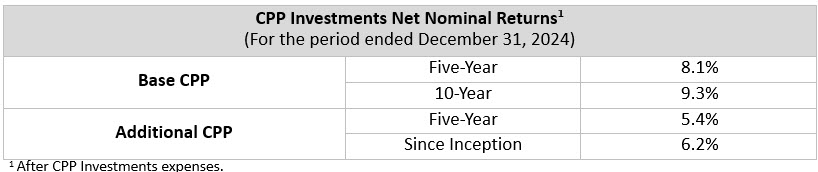

The base CPP account ended its third quarter of fiscal 2025 on December 31, 2024, with net assets of $646.2 billion, compared to $626.1 billion at the end of the previous quarter. The $20.1 billion increase in net assets consisted of $24.6 billion in net income, less $4.5 billion in net base CPP outflows. The base CPP account’s net return for the quarter was 3.9%, and the five-year annualized net return was 8.1%.

The additional CPP account ended its third quarter of fiscal 2025 on December 31, 2024, with net assets of $53.4 billion, compared to $49.0 billion at the end of the previous quarter. The $4.4 billion increase in assets consisted of $1.4 billion in net income and $3.0 billion in net transfers from the additional CPP. The additional CPP account’s net return for the quarter was 2.8%, and the five-year annualized net return was 5.4%.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in its design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in its net contribution profile, the additional CPP account’s assets are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

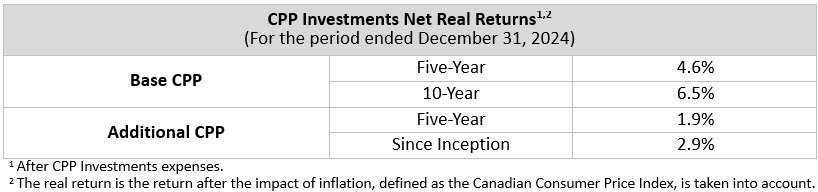

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to meet its financial obligations on any given day. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Corporate development

- Ranked second among 75 pension funds across 15 countries in the 2024 Global Pension Transparency Benchmark developed by Top1000funds.com and CEM Benchmarking. The Global Pension Transparency Benchmark focuses on the transparency and quality of public disclosures relating to the completeness, clarity, information value and comparability of disclosures.

- Awarded the Australian Market Achievement of the Year for 2024 by KangaNews. Last year, CPP Investments was the largest Kangaroo sovereign, supranational, and agency (SSA) borrower in the Australian Dollar Market with A$4.2 billion of issuance.

- Affirmed our support for both of the Canadian Sustainability Disclosure Standards from the Canadian Sustainability Standards Board, which address general sustainability-related disclosures and climate-specific requirements. CPP Investments believes these standards are important for the competitiveness of Canadian companies in global capital markets and for Canadian directors to discharge their duties to the companies they oversee.

- Published Integrating AI and Human Capital through the CPP Investments Insights Institute, which explores how investors, management and boards related to the intersection of artificial intelligence and talent strategies.

Debt issuance

- Announced the addition of Cedar Leaf Capital, Canada’s first majority Indigenous-owned investment dealer, to our Canadian Dollar syndicate in the bond market.

Third-Quarter Investment Highlights

Active Equities

- Invested €600 million through a private placement for a 1.3% interest in the public shares of Denmark-based DSV A/S to support the funding of DSV’s acquisition of Schenker AG. This acquisition enhances the Company’s position as a world leading player within the global transport and logistics industry.

Credit Investments

- Invested US$175 million in a mezzanine loan secured against the Fontainebleau Miami Beach, a full-service, oceanfront resort in Florida, alongside a US$50 million co-investment from Ohana Real Estate Investors.

- Invested across the unitranche term loan and revolving credit facility for Encore, a leading provider of event technology, staging and production services for corporate events in the U.S.

- Committed KRW 473.1 billion (C$479 million) in a separately managed account by TPG Angelo Gordon, targeting real estate credit opportunities in South Korea.

- Completed a US$250 million anchor investment in the Antares Private Credit Fund, which holds Antares-originated loans to private companies in the U.S.

- Invested SEK 1.2 billion (C$150 million) in the holdco facilities of Open Infra, a fibre-to-the-home developer, owner and operator across Sweden and Germany.

- Committed US$300 million in the first-lien term loan issued by Salamanca Infrastructure LLC, which owns in-construction midstream energy assets in the U.S.

- Invested US$100 million in Bain Capital’s financing facility to support its acquisition of PowerSchool. Headquartered in the U.S., PowerSchool is a leader in K-12 administrative software and cloud-based solutions, serving educators in more than 90 countries.

- Invested US$115 million alongside funds managed by Apollo Management in Stone Canyon Industries Holdings’ financing to extend their investments in Morton Salt and Reddy Ice. Morton Salt is the largest, pure-play vertically integrated salt company globally and Reddy Ice is the largest player in the North American packaged ice market.

Private Equity

- Invested €50 million in a single-asset continuation fund transaction with Ardian Expansion for Syclef, a leading European firm specializing in the installation and maintenance of refrigeration and air conditioning systems.

- Invested JPY 11.5 billion (C$105 million) for a 7% stake in Alinamin Pharmaceutical, a Japan-based developer and manufacturer of over-the-counter drug and health supplement products, alongside MBK Partners.

- Committed US$700 million to BPEA Private Equity Fund IX managed by EQT Private Capital Asia, a leading private equity manager in the APAC region focused on large-cap control buyout investments.

- Committed approximately €460 million for a significant minority stake in Regnology, alongside a new investment made from Nordic Capital XI in addition to its current ownership. Headquartered in Germany, Regnology is a global software provider with a focus on regulatory reporting solutions for financial institutions.

- Invested US$180 million alongside Advent in the take-private of Nuvei, a global payments provider based in Montreal, Canada.

- Committed to Accel Growth VII, which will focus on global growth-stage technology investments, and Accel India VIII, which will focus on the consumer, technology and fintech sectors. Accel is a leading global venture capital firm with early- and growth-stage funds across the U.S., Europe and India.

- Exchanged our position in Germany-based Axel Springer SE, an international media and technology company, for a direct majority interest in the classifieds businesses, The Stepstone Group and AVIV Group, which will be held as separate joint venture companies, alongside KKR. Axel Springer SE will remain as a minority co-shareholder in the classified businesses, with an approximate 10% ownership stake.

- Invested in nVent, a global provider of mission-critical electric heat management solutions, alongside Brookfield.

- Invested US$461 million in a multi-asset continuation vehicle with Warburg Pincus involving five companies from Warburg Pincus Global Growth and Warburg Pincus Financial Sector.

- Invested an additional US$50 million in the US$8.6 billion Series J funding of Databricks, a data, analytics and AI company based in San Francisco, bringing our stake to just under 1%. We first invested in Databricks in 2021.

- Committed €167 million to AXA IM Prime Genesis PE Secondaries Fund to acquire indirect exposure to 12 buyout funds and provide primary capital to be used for new fund investments focused on buyout transactions in North America and Europe.

- Co-invested US$50 million for a 5% stake in PropertyGuru, a leading real estate online classifieds company in Southeast Asia, alongside EQT Private Capital Asia.

- Invested US$75 million in a single-asset continuation fund transaction with Court Square Capital Partners for Playcore, a leading U.S.-based manufacturer and distributor of playground and recreational equipment.

- Signed a definitive agreement in support of the proposed merger between Novolex® and Pactiv Evergreen Inc., creating a leading manufacturer in food, beverage and specialty packaging products across North America. We will contribute approximately US$1 billion and will become a significant minority shareholder in the post-merger company.

- Committed JPY 11.5 billion (US$75 million) to Polaris Capital Fund VI. Polaris Capital is a leading Japanese private equity manager, focusing on upper mid-market buyout investments.

- Completed a US$25 million follow-on investment in Human Interest, an affordable, full-service 401(k) and 403(b) retirement-plan provider that seeks to make it easy for small- and medium-sized businesses, alongside NewView Capital, a late-stage venture capital and growth manager.

- Invested alongside Dragoneer in Instructure, a U.S.-based software company servicing the education-end market.

- Committed US$100 million to Accel-KKR Strategic Capital, which will invest in a broad range of transactions primarily focused on the software industry in the secondary market.

- Invested €100 million in a leading online real estate classifieds platform in Spain, Italy and Portugal, alongside Cinven.

- Completed the acquisition of Keywords Studios, a leading international video games service provider, alongside EQT and Temasek. We invested approximately US$515 million for a 24.5% stake in the company.

- Committed US$200 million in aggregate across CVC Growth Partners III and CVC Growth Partners III Co-Investment vehicles, which will invest in middle-market growth-oriented software and tech-enabled business services companies in the U.S. and Europe.

- Completed a follow-on investment of US$8 million in Eruditus as part of the company’s Series F funding round. Eruditus partners with more than 80 top universities globally to provide accessible, high-quality education through its courses, degree programs, professional certificates, and senior executive program.

- Committed KRW 437.5 billion (C$443 million) in a separately managed account, managed by Asia-Pacific real asset manager ESR, targeting credit investment solutions for logistics assets in South Korea.

- Invested US$86 million to acquire an 8% stake in Infocom, a leading online comic platform in Japan, alongside Blackstone Asia.

- Invested US$100 million for an approximate 5% stake in Perficient, a leading provider of end-to-end digital strategy, design and engineering services for global enterprises, alongside EQT Private Capital Asia. Based in the U.S., Perficient has global operations in 40 locations across Asia, the U.S and Latin America, with 28% of delivery staff based in India.

- Invested US$25 million in Cytovale through a Series D funding round, alongside Sands Capital. Based in California, Cytovale is a commercial-stage medical diagnostics company focused on launching IntelliSep, a hospital-based diagnostic tool that rapidly risk-stratifies patients based on their probability of having sepsis.

Real Assets

- Completed three co-investments alongside Quantum Capital Group, a Houston-based private equity firm focused on the energy sector: US$150 million for an approximate 29% stake in Trace Midstream, a Houston-based company with natural gas gathering and transportation assets in the Permian Basin; US$80 million for an approximate 11% stake in QB Energy, a private exploration and production business focused on acquiring and developing natural gas assets; and US$65 million for an approximate 10% stake in Firebird II, a private exploration and production business focused on acquiring and developing upstream assets in the Permian Basin.

- Announced our second data centre joint venture with existing partner Pacific Asset Management Company, a 95:5 KRW 1 trillion (C$1 billion) joint venture to develop carrier-neutral hyperscale data centres in South Korea. We have committed KRW 276 billion (C$285 million) to the joint venture’s initial seed

- Formed a new single-family rental housing joint venture in the U.K. with Kennedy Wilson, a global real estate investment company. We have initially committed £500 million for a 90% stake in the joint venture.

- Signed a joint venture agreement with Equinix, Inc., a digital infrastructure company, and GIC with the intent to jointly raise more than US$15 billion in capital. We have made an initial equity allocation of up to US$2.4 billion and will control a 37.5% equity interest. The joint venture will develop state-of-the-art Equinix xScale data centres in the U.S. to serve the unique core workload deployment needs of the world’s largest cloud service providers, including hyperscalers, which are key players in the AI ecosystem.

Transaction Highlights Following the Quarter

- Completed an investment in the refinancing transaction for Banyan Software. Headquartered in Canada, Banyan Software is a leading acquirer and permanent home for enterprise software companies, with a growing presence across North America, the U.K., Europe, Australia and New Zealand.

- Invested US$80 million in Kestra, a leading wealth management platform in the United States, alongside Stone Point.

- Invested US$517 million in a multi-asset continuation vehicle with PSG Equity L.L.C. (PSG) involving six assets from the PSG III, PSG IV, and PSG Europe I Funds.

- Sold our 50% stake in 2 Queen Street East, an office building in Toronto, Canada. Net proceeds from the sale were C$107 million. Our original investment was made in 2005.

- Formed a KRW 500 billion (C$500 million) joint venture with MGRV, a leading Korean rental housing provider, to develop rental housing projects in Korea. We will hold 95% of the joint venture and have committed up to KRW 133 billion (C$133 million) to the joint venture’s seed projects located within Seoul.

- Signed an agreement to exit our 33.3% equity share in the Goodman UK Partnership (GUKP), resulting in expected net proceeds of £182 million. GUKP was established with Australia’s Goodman Group in 2015, with a focus on developing prime industrial and logistics properties in the U.K.

- Formed a new 95:5 joint venture with Bridge Industrial, a privately owned, vertically integrated real estate operating company and investment manager, to invest in high-quality industrial properties in several core markets across the U.S. We have allocated US$750 million to the joint venture.

- Invested US$212 million in Blackstone Credit’s senior debt and equity issuance to fund its investment in U.S. pipeline assets from EQT Corp.

- Signed a new 50:50 joint venture agreement with Cyrela Brazil Realty, the largest residential real estate developer in Brazil, with an investment target of R$1.7 billion (C$400 million) to develop residential condominiums in São Paulo, Brazil.

- Signed an agreement to sell our entire 15.75% stake in U.S. power producer Calpine Corporation to Constellation Energy as part of Constellation’s acquisition of Calpine. As at signing, net proceeds are expected to be approximately US$700 million in cash and US$1.9 billion in Constellation stock. Our original investment in the company was made in 2018.

- Invested US$90 million alongside Thoma Bravo in Qlik, a U.S.-based software company that provides solutions across business intelligence, analytics and data integration and quality. This brings our stake in Qlik to approximately 3%.

- Acquired a position in equity tranches of Blackstone-managed European and U.S. collateralized loan obligations for approximately €120 million from BGLF, a London Stock Exchange-listed vehicle.

- Announced the sale of our 45% stake in the Goodman North American Partnership (GNAP), for expected net proceeds of US$2.2 billion. GNAP was established with Australia’s Goodman Group in 2012, with a mandate to invest in high-quality logistics and industrial properties in key North American markets.

- Agreed to sell our 49% interest in four real estate joint venture projects with Chinese real estate company Longfor Group Holdings for expected net proceeds of C$235 million before closing adjustments. The partnership with Longfor was first established in 2014.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 22 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At December 31, 2024, the Fund totalled C$699.6 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Instagram or on X @CPPInvestments.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook, Instagram and X are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

Article Contacts

For More Information:

Frank Switzer

Public Affairs & Communications

Tel: +1 416 523 8039

fswitzer@cppib.com