U.S. China tensions. Wars in Ukraine and the Middle East. The breakdown of multilateral institutions. In a matter of years, the forces behind decades of global economic growth have been weakened by one blow after another. Geopolitical relationships have frayed, supply chains have buckled and regulatory environments have grown uncertain. Adding to the complexity, artificial intelligence has surged to the forefront of transformational technologies—introducing both risks and opportunities.

Where does all of this leave institutional investors? In this issue, Michel Leduc explores how the global investment landscape has transformed, Ed Cass explains why shifting geopolitics are challenging long-standing assumptions, and Nadeem Janmohamed identifies the five key things every investor should understand about AI.

Five minutes with Michel Leduc

Has the “golden era” of institutional investing come to an end? Michel Leduc, CPP Investments’ Head of Global Public Affairs and Communications, explores evolving industrial policy, concentration risks, and why investors must go into today’s markets with “eyes wide open.”

“Challenge your beliefs”: Ed Cass on investing in turbulent times

Over the past several years, Ed Cass has seen first-hand how labour issues, political tensions and technological change have impacted asset prices. In this conversation, he reflects on the rapid advancement of AI, the Fed pivot, and why the current investment landscape is unlike any we’ve seen before.

Faster, smarter, more powerful: Five AI trends every investor should understand

With billions in investment still to come, the furious momentum behind artificial intelligence is unlikely to let up anytime soon. Nadeem Janmohamed, Managing Director of North American Active Equities identifies the mega trends investors should keep an eye on.

Done Deals: Hohe See and Albatros

In 2018, CPP Investments bought a 24.5% stake in a pair of offshore wind assets located off the coast of Germany’s North Sea. Then the world changed.

Who will win the global AI race?

By Jack Purich, Managing Director, Balancing Portfolio Implementation

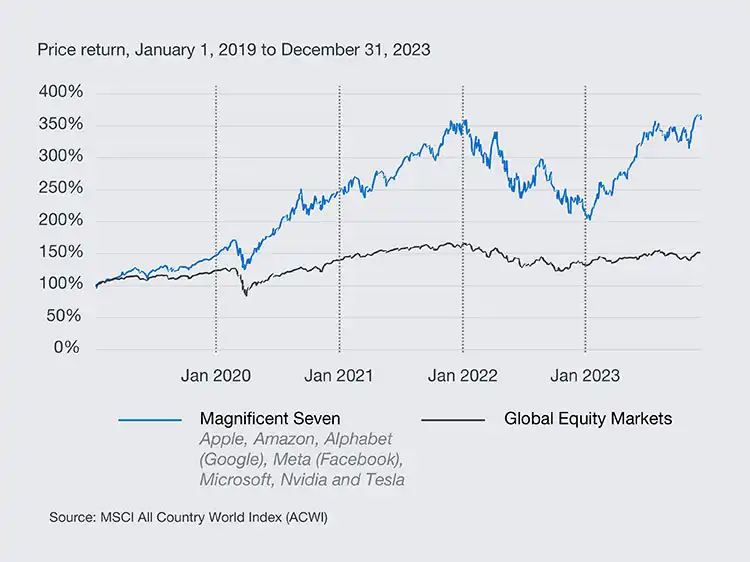

Artificial Intelligence (AI) has the potential to revolutionize the way the economy works and how businesses generate profits. As a result, global markets have reacted with a flurry of excitement to recent AI breakthroughs and seem to have already picked the “winners” of AI. This group of technology giants—nicknamed The Magnificent Seven— include Apple, Amazon, Alphabet (Google), Meta (Facebook), Microsoft, Nvidia and Tesla.

In case you missed it

- CPP Investments comes first among national pension funds in a ranking of 10 year returns by Global SWF, a New York-based pension industry specialist.

- John Graham, President and CEO of CPP Investments discusses the Net Zero transition with David Blood, co-founder of Generation Investment Management and a pioneer of sustainable investing (video).

- A Fund for Canada: John Graham shares his year end letter.

“Challenge your beliefs”: Investing in times of geopolitical turbulence

Over the past several years, Ed Cass has seen first-hand how labour issues, political tensions and technological change have impacted asset

Who will win the global AI race?

Artificial Intelligence (AI) has the potential to revolutionize the way the global economy works and how many businesses generate profits.

Done Deals: Hohe See and Albatros

Offshore wind at scale. That was the draw when CPP Investments bought its 24.5% stake in Hohe See and Albatros in 2018.