The Canada Pension Plan (CPP) is often called one of the crown jewels of Canada – for good reason. It’s one of our greatest public policy success stories, but it wasn’t always this way.

The CPP was unsustainable in the 1990s until federal and provincial governments agreed to reforms to fix the national pension plan. This included the creation of our organization, CPP Investments, to manage the assets of the CPP Fund to ensure that it would be sustainable for future generations.

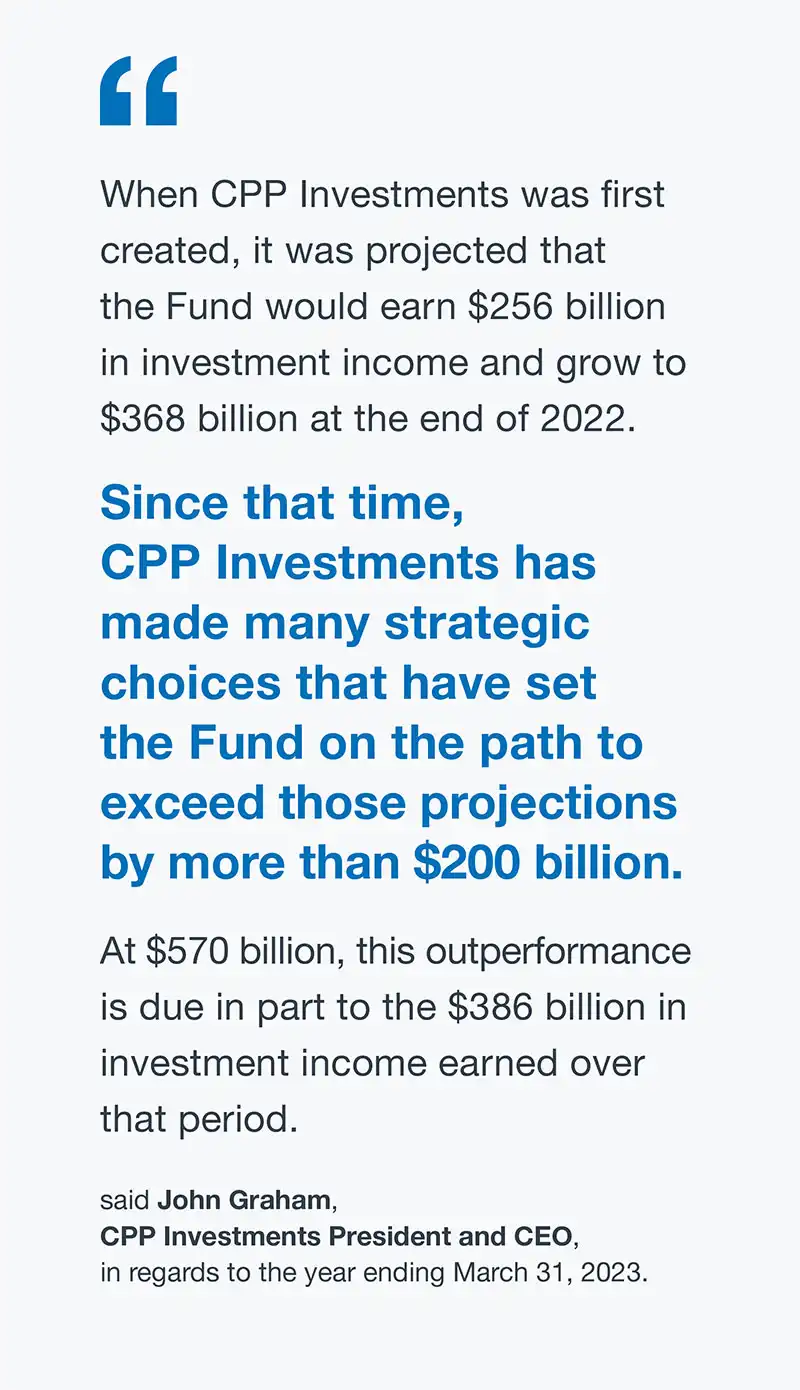

In 1997, CPP Investments was established with a mandate to invest the funds of the CPP to maximize returns without undue risk of loss. Since then, the CPP Fund has become one of the largest and most successful pension funds in the world. Our active investing strategy has helped us grow the CPP Fund from $100 billion in 2006, which is when we started active management of the CPP Fund, to $576 billion in assets today.

Passive management, or index investing, requires portfolio managers to select investments that mirror a market index with the goal of matching its performance.

Active management, however, is a strategy that encourages portfolio managers to make specific investments with the goal of outperforming the market or an investment benchmark index.

CPP Investments decided to adopt an active management strategy to empower our teams to actively invest across asset classes and regions in a manner that would allow us to find the world’s best opportunities. This strategy allows us to pursue above-benchmark returns and meet our goal of ensuring the CPP Fund remains sustainable for generations.

Active investing benefits

CPP Investments has unique advantages, which we call comparative advantages, that support our ability to succeed in competitive global financial markets. This includes our long-term investment horizon, our significant size and scale and our certainty of assets, being the beneficiaries of generally predictable and stable cashflows.

Active investing means that we can be resourceful in finding investments with better returns. It also provides the flexibility to adjust our portfolios as market conditions change. We can uncover promising new opportunities by actively searching for them, setting us apart from other institutional investors.

Some additional benefits of active management include the ability to:

- Participate in large private transactions.

- Profit from buying undervalued stocks (or selling overvalued ones).

- Manage the risks and capture the opportunities that come with climate change.

The scope to explore these avenues would be limited if we confined ourselves exclusively to a passive investment approach.

We recognize that while many active investors seek above-market returns, few consistently achieve them. Seeking additional sources of return through active management increases our cost and risk profile, including the leverage, liquidity, operational, legal and regulatory risks we face. For those reasons, we don’t make these decisions lightly. They’re grounded in our belief that our comparative advantages support our ability to generate incremental returns in the best interests of the CPP’s more than 21 million contributors and beneficiaries. This allows us to focus on delivering maximized returns from all income sources over the long term.

To pursue this approach, we needed to secure the talent, skills and global capabilities to generate research and insights, along with the right internal processes and operational support. We also had to develop an investing approach that was patient, measured and disciplined.

Determining which companies or opportunities outperform the market is challenging for any investor. Our teams use a variety of strategies for buying, weighting and selling individual investments as we seek to generate value in both rising and falling markets.

Measuring our investment performance

Active management requires us to measure our performance relative to benchmarks to see how well our investment strategies are working. That’s why we’ve established benchmarks of passive, public market indices called Reference Portfolios that reflect the risk of our investment strategies. We have an overall benchmark for our investment portfolio, and we have specific benchmarks for each of our active investment strategies. This allows us to assess our performance over the long term for both the total investment portfolio and each of our active investment strategies, measured in both percentage and dollar terms, after deducting all expenses.

Since the CPP is designed to serve generations of Canadians, evaluating the performance of CPP Investments over extended periods is more suitable than single years. As of our last fiscal year ended March 31, 2023, the CPP Fund outperformed the aggregated reference portfolios on annual, five- and 10-year periods, on a relative basis.

In fiscal 2023, net dollar value-added (the amount earned above the overall Reference Portfolio) for the CPP Fund was $2 billion. Over five- and 10-year periods, the CPP Fund delivered an aggregate dollar value-added of $7 billion and a dollar value-added of $18 billion, respectively.

We also calculate compounded dollar value-added as the total net dollars that CPP Investments has added to the CPP Fund through active management, above the returns of the Reference Portfolio. To date, CPP Investments has generated $47 billion of compounded dollar value-added since 2006, the inception of our active management strategy.

Active management has helped enable us to rank among the best investment professionals in the world. The CPP ensures working Canadians can retire with financial support, and CPP Investments helps grow the CPP Fund so it will be there for generations. We have a dedicated team of experts working hard to create value for Canadians – today, tomorrow and for decades to come.

The Canada Pension Plan (CPP) is often called one of the crown jewels of Canada – for good reason. It’s one of our greatest public policy success stories, but it wasn’t always this way. The CPP was unsustainable in the 1990s until federal and provincial governments agreed to reforms to fix the national pension plan. This included the creation of our organization, CPP Investments, to manage the assets of the CPP Fund to ensure that it would be sustainable for future generations. In 1997, CPP Investments was established with a mandate to invest the funds of the CPP to maximize returns without undue risk of loss. Since then, the CPP Fund has become one of the largest and most successful pension funds in the world. Our active investing strategy has helped us grow the CPP Fund from $100 billion in 2006, which is when we started active management of the CPP Fund, to $576 billion in assets today. Choosing our strategy Passive management, or index investing, requires portfolio managers to select investments that mirror a market index with the goal of matching its performance. Active management, however, is a strategy that encourages portfolio managers to make specific investments with the goal of outperforming the market or an investment benchmark index. CPP Investments decided to adopt an active management strategy to empower our teams to actively invest across asset classes and regions in a manner that would allow us to find the world’s best opportunities. This strategy allows us to pursue above-benchmark returns and meet our goal of ensuring the CPP Fund remains sustainable for generations. Active investing benefits CPP Investments has unique advantages, which we call comparative advantages, that support our ability to succeed in competitive global financial markets. This includes our long-term investment horizon, our significant size and scale and our certainty of assets, being the beneficiaries of generally predictable and stable cashflows. Active investing means that we can be resourceful in finding investments with better returns. It also provides the flexibility to adjust our portfolios as market conditions change. We can uncover promising new opportunities by actively searching for them, setting us apart from other institutional investors. Some additional benefits of active management include the ability to: Participate in large private transactions. Profit from buying undervalued stocks (or selling overvalued ones). Manage the risks and capture the opportunities that come with climate change. The scope to explore these avenues would be limited if we confined ourselves exclusively to a passive investment approach. Investment selection We recognize that while many active investors seek above-market returns, few consistently achieve them. Seeking additional sources of return through active management increases our cost and risk profile, including the leverage, liquidity, operational, legal and regulatory risks we face. For those reasons, we don’t make these decisions lightly. They’re grounded in our belief that our comparative advantages support our ability to generate incremental returns in the best interests of the CPP’s more than 21 million contributors and beneficiaries. This allows us to focus on delivering maximized returns from all income sources over the long term. To pursue this approach, we needed to secure the talent, skills and global capabilities to generate research and insights, along with the right internal processes and operational support. We also had to develop an investing approach that was patient, measured and disciplined. Determining which companies or opportunities outperform the market is challenging for any investor. Our teams use a variety of strategies for buying, weighting and selling individual investments as we seek to generate value in both rising and falling markets. Measuring our investment performance Active management requires us to measure our performance relative to benchmarks to see how well our investment strategies are working. That’s why we’ve established benchmarks of passive, public market indices called Reference Portfolios that reflect the risk of our investment strategies. We have an overall benchmark for our investment portfolio, and we have specific benchmarks for each of our active investment strategies. This allows us to assess our performance over the long term for both the total investment portfolio and each of our active investment strategies, measured in both percentage and dollar terms, after deducting all expenses. Since the CPP is designed to serve generations of Canadians, evaluating the performance of CPP Investments over extended periods is more suitable than single years. As of our last fiscal year ended March 31, 2023, the CPP Fund outperformed the aggregated reference portfolios on annual, five- and 10-year periods, on a relative basis. In fiscal 2023, net dollar value-added (the amount earned above the overall Reference Portfolio) for the CPP Fund was $2 billion. Over five- and 10-year periods, the CPP Fund delivered an aggregate dollar value-added of $7 billion and a dollar value-added of $18 billion, respectively. We also calculate compounded dollar value-added as the total net dollars that CPP Investments has added to the CPP Fund through active management, above the returns of the Reference Portfolio. To date, CPP Investments has generated $47 billion of compounded dollar value-added since 2006, the inception of our active management strategy. Active management has helped enable us to rank among the best investment professionals in the world. The CPP ensures working Canadians can retire with financial support, and CPP Investments helps grow the CPP Fund so it will be there for generations. We have a dedicated team of experts working hard to create value for Canadians – today, tomorrow and for decades to come. Where do my CPP contributions go? When you contribute to the CPP, you’re participating in one of the most successful pension plans on the planet. Learn more