When you contribute to the Canada Pension Plan (CPP), you’re participating in one of the most successful pension plans on the planet.

The CPP is designed to help provide a foundation for your financial security in retirement. It’s a pension system that has worked for decades. However, we know there are sometimes questions about where your hard-earned money actually goes. Here’s how it works.

Who contributes to the CPP?

Anyone above the age of 18 employed in Canada (outside of Quebec) contributes. You don’t need to sign up – you and your employer automatically pay into this joint federal and provincial retirement program through paycheque contributions. Self-employed people in Canada contribute both the employee and employer rates. And it’s available to anyone working here, not only Canadian citizens.

Contributions are calculated as a percentage of your yearly earnings up to a maximum contribution amount for the year. In 2024, the contribution rate is 5.95% for both employee and employer, according to the Government of Canada’s website. CPP contributions are made until you have earned up to a maximum of $68,500 in yearly earnings. The maximum amount is adjusted each year to keep pace with wages.

For example, if you earn $70,000 annually, both you and your employer would each contribute up to $3,867.50 towards your CPP pension until you reach $68,500 in earnings, for a total of $7,735.00 for the year. After you earn $68,500 in a year, your CPP contributions stop until the next calendar year.

What happens when the money comes off my paycheque?

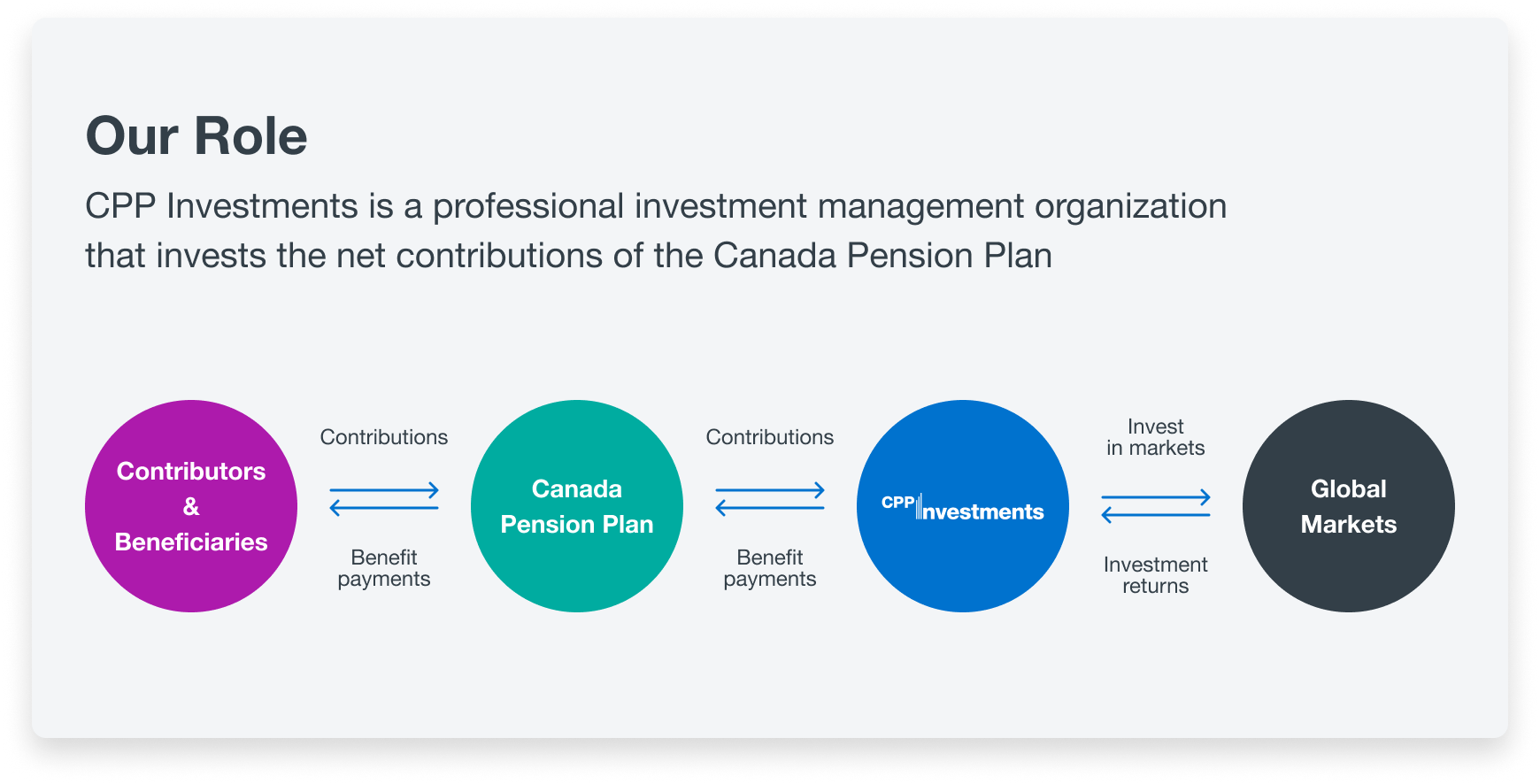

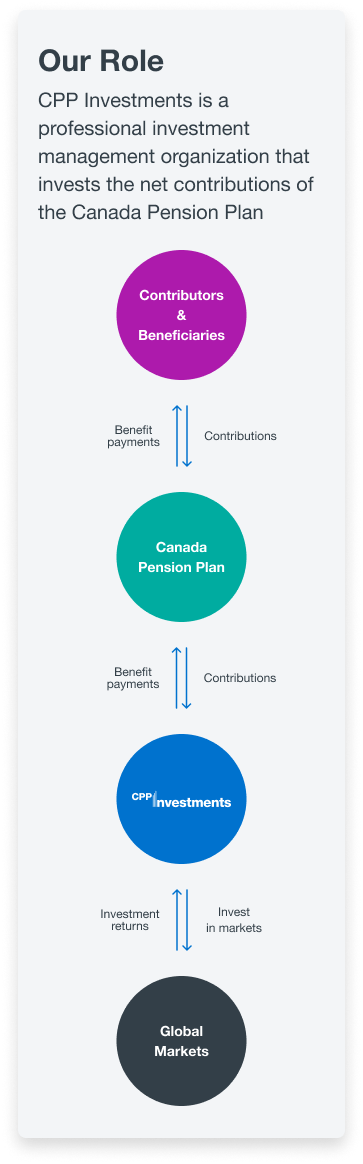

Your CPP contributions are deducted by the Canada Revenue Agency (CRA), which keeps track of how much money you have contributed to the CPP over your working life in Canada. Contributions are first used to pay CPP benefits to retirees and other beneficiaries while the remaining money is channeled to CPP Investments and is invested in the CPP Fund.

CPP Investments is a professional investment management organization that invests the CPP’s net contributions to help ensure the long-term financial sustainability of the CPP. Investment professionals across the organization’s global offices seek the best opportunities to invest that money in asset classes and markets around the world with a prudent, measured and flexible approach to help ensure the CPP Fund is safe and secure today, tomorrow and for decades to come.

Managing the CPP Fund is a job we take very seriously. We invest for the long term – not only for your retirement, but for the retirement of your children, grandchildren and great-grandchildren, too.

Given the large size of the CPP Fund ($646.8 billion at June 30, 2024), our global footprint and our long investment horizon, we can participate in some of the most unique and sought-after investments.

Here are some examples:

- 407 ETR (Canada) – the first all-electronic open-access toll highway in the world.

- ChargePoint (United States) – the world’s leading electric vehicle charging network, with tens-of-thousands of places to charge on its network around the world.

- Smart Fit (Brazil) – Latin America’s largest fitness chain.

- Octopus Energy (United Kingdom) – a global energy tech pioneer that uses technology to unlock a customer-focused and affordable green energy revolution.

- Keytruda (global royalties) – royalty interests on worldwide sales of an anti-PD-1, a market-leading cancer therapy.

- GLP industrial portfolio (Japan) – the joint venture develops modern logistics facilities.

How much money will I get back when I retire?

CPP benefit payments are administered by the Government of Canada. Generally, the amount you will receive in CPP benefits during retirement depends on:

- The age you start receiving your CPP benefits;

- How much you contributed and the number of years you contributed; and

- Your average earnings throughout your working life in Canada.

The maximum monthly amount you could receive if you started your CPP at age 65 in 2024 would be $1,364.60, based on contributing the yearly maximum amount for 40 years. The average monthly payment for new benefits starting in April 2024 at age 65 was $816.52.

There are several other factors that may affect your pension amount. To learn more, visit the Government of Canada’s website.

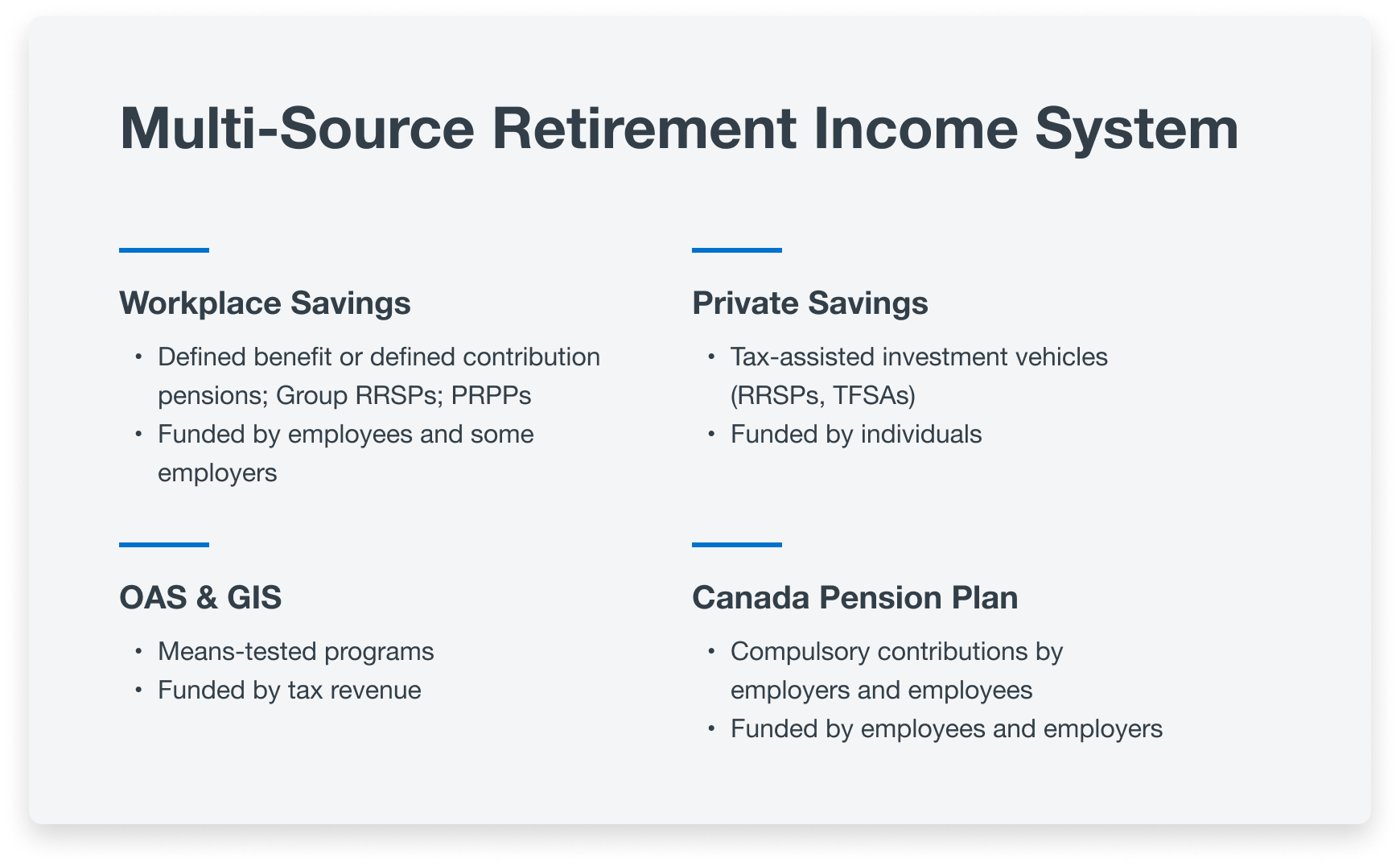

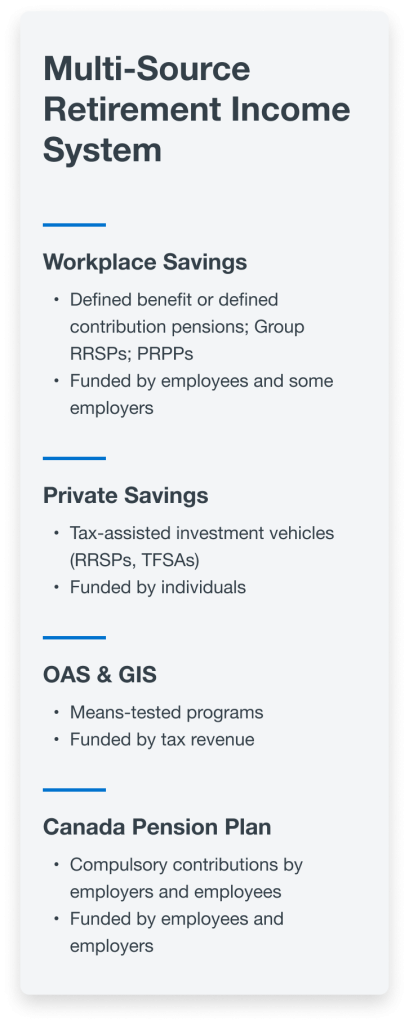

Don’t forget: The CPP is intended to be only one pillar of your retirement plan – it’s meant to be a base for your retirement income, not cover it entirely. A full retirement plan should include private savings, workplace savings and other government programs combined with the CPP.

With the CPP enhancement initiated in 2019, once fully implemented, CPP benefits are designed to replace up to 33% of the average worker’s wage, up from replacing up to 25% of the average wage before the enhancement was introduced.

How do I know the CPP will be there for me when I retire?

CPP Investments was created to help ensure the long-term financial sustainability of the CPP. Every three years, an independent sustainability review is conducted by the Office of the Chief Actuary, an independent federal body that provides checks and balances on the future costs of the CPP. In the most recent review published in December 2022, the Chief Actuary reaffirmed that, as of December 31, 2021, the CPP continues to be sustainable for at least the next 75 years at current contribution rates.

Your pension is your future, and we’re building it together. The CPP is the bedrock of your retirement benefits, and CPP Investments is working hard to help ensure it’ll be there for you when you need it.

Rest assured, the CPP Fund is in good hands.

When you contribute to the Canada Pension Plan (CPP), you’re participating in one of the most successful pension plans on the planet. The CPP is designed to help provide a foundation for your financial security in retirement. It’s a pension system that has worked for decades. However, we know there are sometimes questions about where your hard-earned money actually goes. Here’s how it works. Who contributes to the CPP? Anyone above the age of 18 employed in Canada (outside of Quebec) contributes. You don’t need to sign up – you and your employer automatically pay into this joint federal and provincial retirement program through paycheque contributions. Self-employed people in Canada contribute both the employee and employer rates. And it’s available to anyone working here, not only Canadian citizens. Contributions are calculated as a percentage of your yearly earnings up to a maximum contribution amount for the year. In 2024, the contribution rate is 5.95% for both employee and employer, according to the Government of Canada’s website. CPP contributions are made until you have earned up to a maximum of $68,500 in yearly earnings. The maximum amount is adjusted each year to keep pace with wages. For example, if you earn $70,000 annually, both you and your employer would each contribute up to $3,867.50 towards your CPP pension until you reach $68,500 in earnings, for a total of $7,735.00 for the year. After you earn $68,500 in a year, your CPP contributions stop until the next calendar year. What happens when the money comes off my paycheque? Your CPP contributions are deducted by the Canada Revenue Agency (CRA), which keeps track of how much money you have contributed to the CPP over your working life in Canada. Contributions are first used to pay CPP benefits to retirees and other beneficiaries while the remaining money is channeled to CPP Investments and is invested in the CPP Fund. CPP Investments is a professional investment management organization that invests the CPP’s net contributions to help ensure the long-term financial sustainability of the CPP. Investment professionals across the organization’s global offices seek the best opportunities to invest that money in asset classes and markets around the world with a prudent, measured and flexible approach to help ensure the CPP Fund is safe and secure today, tomorrow and for decades to come. Managing the CPP Fund is a job we take very seriously. We invest for the long term – not only for your retirement, but for the retirement of your children, grandchildren and great-grandchildren, too. Given the large size of the CPP Fund ($646.8 billion at June 30, 2024), our global footprint and our long investment horizon, we can participate in some of the most unique and sought-after investments. Here are some examples: 407 ETR (Canada) – the first all-electronic open-access toll highway in the world. ChargePoint (United States) – the world’s leading electric vehicle charging network, with tens-of-thousands of places to charge on its network around the world. Smart Fit (Brazil) – Latin America’s largest fitness chain. Octopus Energy (United Kingdom) – a global energy tech pioneer that uses technology to unlock a customer-focused and affordable green energy revolution. Keytruda (global royalties) – royalty interests on worldwide sales of an anti-PD-1, a market-leading cancer therapy. GLP industrial portfolio (Japan) – the joint venture develops modern logistics facilities. How much money will I get back when I retire? CPP benefit payments are administered by the Government of Canada. Generally, the amount you will receive in CPP benefits during retirement depends on: The age you start receiving your CPP benefits; How much you contributed and the number of years you contributed; and Your average earnings throughout your working life in Canada. The maximum monthly amount you could receive if you started your CPP at age 65 in 2024 would be $1,364.60, based on contributing the yearly maximum amount for 40 years. The average monthly payment for new benefits starting in April 2024 at age 65 was $816.52. There are several other factors that may affect your pension amount. To learn more, visit the Government of Canada’s website. Don’t forget: The CPP is intended to be only one pillar of your retirement plan – it’s meant to be a base for your retirement income, not cover it entirely. A full retirement plan should include private savings, workplace savings and other government programs combined with the CPP. With the CPP enhancement initiated in 2019, once fully implemented, CPP benefits are designed to replace up to 33% of the average worker’s wage, up from replacing up to 25% of the average wage before the enhancement was introduced. How do I know the CPP will be there for me when I retire? CPP Investments was created to help ensure the long-term financial sustainability of the CPP. Every three years, an independent sustainability review is conducted by the Office of the Chief Actuary, an independent federal body that provides checks and balances on the future costs of the CPP. In the most recent review published in December 2022, the Chief Actuary reaffirmed that, as of December 31, 2021, the CPP continues to be sustainable for at least the next 75 years at current contribution rates. Your pension is your future, and we’re building it together. The CPP is the bedrock of your retirement benefits, and CPP Investments is working hard to help ensure it’ll be there for you when you need it. Rest assured, the CPP Fund is in good hands. CPP Investments Net Assets Total $576 Billion at Second Quarter Fiscal 2024 CPP Investments ended its second quarter of fiscal 2024 on September 30, 2023, with net assets of $576 billion. Learn more