All figures in Canadian dollars unless otherwise noted.

Second-Quarter Performance1:

- Net assets increase by $1 billion

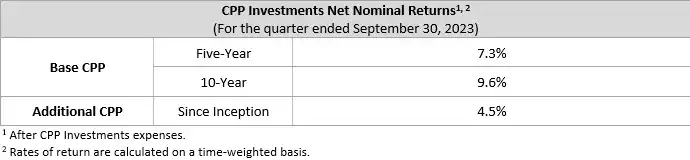

- 10-year annualized net return of 9.6%

TORONTO, ON (November 9, 2023): Canada Pension Plan Investment Board (CPP Investments) ended its second quarter of fiscal 2024 on September 30, 2023, with net assets of $576 billion, compared to $575 billion at the end of the previous quarter.

The $1 billion increase in net assets for the quarter consisted of $488 million in net income and $700 million in net transfers from the Canada Pension Plan (CPP).

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a 10-year annualized net return of 9.6%. For the quarter, the Fund’s net return was 0.1%. In the 10-year period up to and including the second quarter of fiscal 2024, CPP Investments has contributed $311 billion in cumulative net income to the Fund.

For the six-month fiscal year-to-date period, the Fund increased by $6 billion consisting of a net loss of $4 billion, plus $10 billion in net CPP contributions. For the period, the Fund’s net return was negative 0.7%.

“Our diversified portfolio remains resilient, and while we expect these challenging investing conditions to persist for the near term, we are confident that our active management strategy will continue to deliver positive long-term results for CPP contributors and beneficiaries,” said John Graham, President and CEO, CPP Investments.

The Fund’s quarterly results were driven by positive performance in credit and private equities and gains across U.S. dollar-denominated assets, which benefited from a strengthening U.S. dollar relative to the Canadian dollar. Returns were offset by losses in fixed income due to continued high interest rates and weak performance in public equities as global markets declined.

Performance of the Base and Additional CPP Accounts

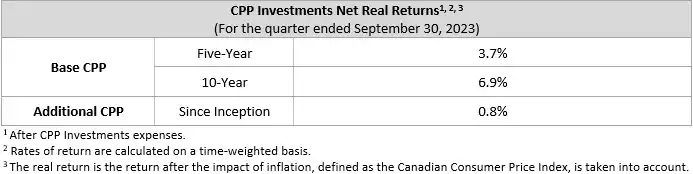

The base CPP account ended its second quarter of fiscal 2024 on September 30, 2023, with net assets of $546 billion, compared to $547 billion at the end of the previous quarter. The $1 billion decrease in net assets consisted of $1 billion in net income, less $2 billion in net base CPP outflows. The base CPP account’s net return for the quarter was 0.2%, and the five-year annualized net return was 7.3%.

The additional CPP account ended its second quarter of fiscal 2024 on September 30, 2023, with net assets of $30 billion, compared to $28 billion at the end of the previous quarter. The $2 billion increase in assets consisted of a net loss of $392 million and $3 billion in net additional CPP contributions. The additional CPP account’s net return for the quarter was negative 1.3%, and the net return since inception in 2019 was 4.5%.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Board appointments

- Welcomed the designation of Dean Connor as Chairperson of the Board of Directors, effective October 27, 2023. Mr. Connor succeeded Heather Munroe-Blum, CPP Investments’ Chairperson since 2014, whose final term as Chairperson and Director expired in October. Mr. Connor has served on the Board since August 2021.

- Welcomed Nadir Mohamed to the Board of Directors. Appointed in October 2023, Mr. Mohamed is the retired President and Chief Executive Officer of Rogers Communications Inc. He brings extensive business leadership experience to the Board, as well as expertise in stakeholder management, enterprise risk management and cultivating talent.

- Welcomed the reappointments of Ashleigh Everett, John Montalbano, Mary Phibbs, and Boon Sim as Directors of the Board for three-year terms effective October 2023.

Executive announcements

- Manroop Jhooty was appointed Senior Managing Director & Head of Total Fund Management. In this role, Mr. Jhooty is responsible for the Total Fund Management department where he leads the balancing and financing portfolio, which is invested in global public securities, as well as balance sheet management, tactical positioning, trading and portfolio design. Mr. Jhooty joined CPP Investments in 2019.

Corporate developments

- Published our 2023 Report on Sustainable Investing, which focuses on how we embed sustainable investing across the investment life cycle to create value and progress on our net-zero commitment.

- Published Road to Zero: Decarbonization Investment Approach Progress Report through the CPP Investments Insights Institute, which shares learnings from the Fund’s first year implementing its decarbonization investment approach. The approach involves supporting portfolio companies as they reduce emissions to build value over the long term.

Second-Quarter Investment Highlights

Credit Investments

- Invested €20 million into a syndicated credit-linked note with Banco Santander, a leading Spanish financial institution, for a diversified portfolio of small and medium-sized enterprise loans.

- Invested €60 million into a syndicated credit-linked note with a leading global bank headquartered in Europe for a diversified portfolio of corporate loans.

- Completed a multi-year forward flow agreement with Exeter Finance LLC, a U.S. indirect auto finance company, to acquire up to US$200 million per year in residual certificates of auto loan receivables securitizations.

- Invested US$150 million in Cornerstone OnDemand’s incremental first-lien term loan. Based in the U.S., Cornerstone OnDemand is a global leader in learning and talent management software-as-a-service solutions.

- Invested £93 million in a debt facility to Vårgrønn, owner of a 20% stake in Dogger Bank Wind Farm, which is an offshore wind farm currently under construction, located off the coast of the U.K.

- Received net proceeds of US$581 million from the sales of U.S. oil and natural gas mineral and royalty interests owned by LongPoint Minerals, LLC and LongPoint Minerals II, LLC, which CPP Investments owns stakes of 72% and 44%, respectively. LongPoint Minerals, LLC and LongPoint Minerals II, LLC acquired their assets between 2016-2021.

Private Equity

- Invested US$206 million to acquire positions in two fund-of-fund vehicles that are invested in buyout, growth buyout and venture funds across a wide range of industries, primarily in the U.S.

- Completed the secondary purchase of a US$100 million commitment to Oak Hill Capital Partners V, which focuses on investing across the industrials, media & communications and business services in the U.S.

- Committed C$200 million to the Canadian private equity market through an evergreen Canadian mid-market mandate managed by Northleaf Capital Partners, a Toronto-headquartered global private markets investment firm. The mandate will target investments in Canadian buyout and growth funds, secondary investments and direct co-investments.

- Invested US$40 million in Redwood Materials Inc., a U.S. company developing a closed-loop supply chain for lithium-ion batteries, through an equity funding round. This is our third investment in the company for a total of US$150 million.

- Invested US$50 million in ServiceTitan, Inc. through an equity financing round and a secondary transaction. Headquartered in the U.S., ServiceTitan is a cloud-based software platform built to power trades businesses.

- Invested US$19 million in Works Human Intelligence, a leading human capital management software provider in Japan, alongside Bain Capital Asia.

- Committed €500 million to CVC Capital Partners IX, L.P., which focuses on control and shared-control buyouts across industries primarily in Europe and the Americas.

- Committed US$150 million to American Industrial Partners Capital Fund VIII, which will primarily target value-oriented, control investments in the North American industrials sector.

- Committed US$150 million to Hellman & Friedman Capital Partners XI, which focuses on leveraged buyouts and growth capital opportunities in North America and Europe, primarily in the technology & software, healthcare, financials and consumer & retail sectors.

- Exited our 2016 commitment to STAR Capital Partners III through a secondary transaction, generating net proceeds of €96 million. STAR Capital is a mid-market, U.K.-based private equity firm focused on buyout and growth opportunities.

- Exited our co-investment in Vistra, a leading provider of trust, fund and corporate services based in Hong Kong with a resilient, scalable, and enterprise-wide technology platform. Net proceeds from the sale were approximately C$155 million. Our original investment was made in 2015 alongside BPEA EQT.

- Exited our co-investment in Coforge, a leading technology services provider in India. Net proceeds from the sale were approximately C$145 million. Our original investment was made in 2019 alongside BPEA EQT.

- Completed a structured liquidity transaction, partially divesting 12 North American energy funds, generating gross proceeds of approximately US$860 million with the opportunity for further distributions.

Real Assets

- Invested US$500,000 in Mombak, a Brazil-based venture-backed carbon removal startup investment manager focused on reforesting the Amazon, and committed up to US$30 million to The Amazon Restoration Fund.

- Announced a new partnership with Amsterdam-based Power2X, in which we will invest an initial €130 million to accelerate the growth of Power2X as a development platform and fund green molecule projects. Power2X is a leading European green molecule developer and advisor focused on the decarbonization of industrial value chains.

- Sold our 45% stake in a portfolio of medical office buildings in Southern California. Net proceeds from the sale were approximately US$100 million. Our original investments were made between 2015-2017.

Transaction Highlights Following the Quarter

- Committed US$240 million to TPG Partners IX, L.P., which focuses primarily on healthcare, software and digital media & communications, and US$60 million to TPG Healthcare Partners II, L.P., which focuses solely on healthcare. The funds target upper middle-market and large growth buyouts in North America and Western Europe.

- Committed up to US$90 million in junior financing to fund up to US$820 million of loans originated by Service Finance Company, a U.S. home improvement financial services company.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2023, the Fund totalled C$576 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Instagram or on X @CPPInvestments.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

1 Certain figures may not add up due to rounding.

Article Contacts

Frank Switzer

Public Affairs & Communications

fswitzer@cppib.com

T: +1 416 523 8039